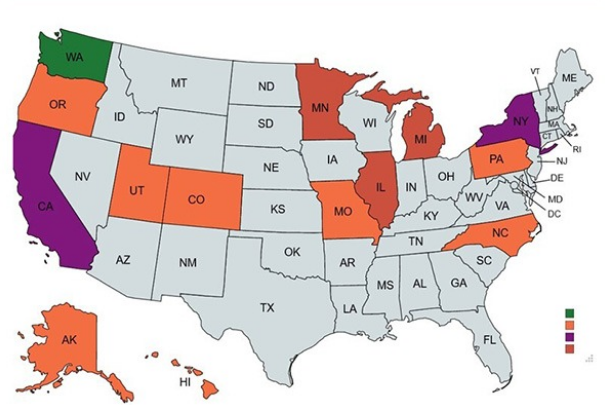

Last year, the long-term care tax in Washington State caused quite a stir. As the first state to take the plunge, it tested the waters for the entire United States under immense pressure. Now, California is planning to implement a mandatory long-term care tax, with an expected start date of January 1, 2024. In addition, a New York Senate bill has proposed a long-term care tax similar to Washington State’s. Ten other states, including Oregon, Hawaii, Colorado, Pennsylvania, Minnesota, Michigan, Illinois, North Carolina, Utah, and Missouri, are also considering implementing long-term care taxes.

This is an inevitable trend. With the aging population in the United States becoming an increasingly severe issue, the demand for long-term care continues to grow. Governments have realized that long-term care will become a significant burden. To address this challenge, state governments are preparing to impose mandatory long-term care taxes to increase the prevalence of long-term care insurance and alleviate the burden on families and governments.

States that have passed and are planning State-wide LTC program

Washington State Long-Term Care Tax Recap

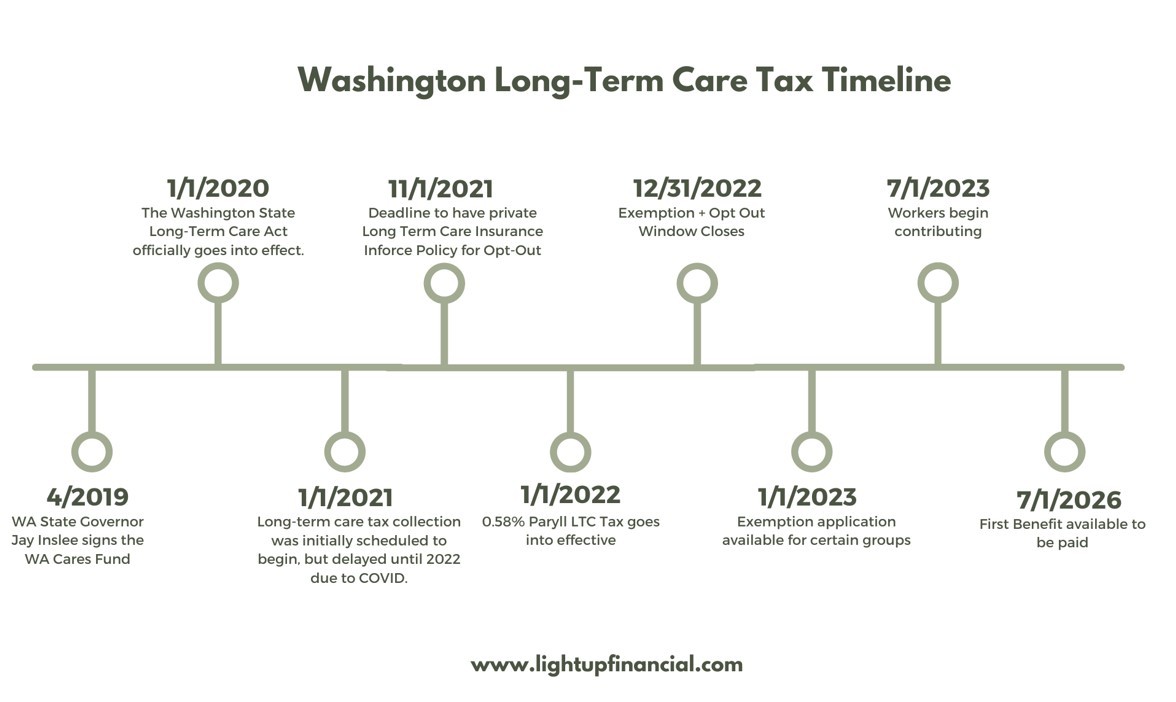

In April 2019, Washington State signed the Washington Cares Fund (WA Cares Fund), which, after being delayed by COVID, began collecting a 0.58% long-term care tax on January 1, 2022. Washington State stipulated that if long-term care insurance was purchased before November 1, 2021, residents could opt-out of the long-term care tax between October 1, 2021, and December 31, 2022.

Data shows that out of 3.8 million employees, about 480,000 (13%) opted out of the Washington Cares Fund by purchasing group or individual long-term care insurance or life insurance with long-term care provisions. This led to a surge in demand, with the long-term care insurance market in the United States growing by at least 200% in 2021, and some insurance companies announcing they would no longer sell long-term care insurance to Washington residents during the opt-out period.

87% of employees chose to pay the 0.58% long-term care tax. If they pay the tax for more than ten years, the government can provide a daily long-term care subsidy of up to $100, with a lifetime maximum of $36,500. However, starting in 2024, the government will reassess every two years, adjusting the tax rate based on inflation and actual demand. Whether this is a good deal depends on individual family circumstances.

Starting in January 2023, residents who live outside of Washington State, hold non-immigrant work visas, are military spouses, or are highly disabled veterans can apply for an exemption from the long-term care tax. However, the Washington State government is also considering re-certifying those who opted out by purchasing long-term care insurance.

From signing to implementation, the government’s timeline is usually quite short, and various issues arise during the actual operation. The government continues to optimize the process.

California Long-Term Care Tax Analysis

Current Long-Term Care Situation in California

🔺 California’s aging population issue is severe. By 2030, the population aged 65 and over in California will reach 9 million. The government has a responsibility to provide sufficient long-term care services for this large elderly population. However, the prevalence of long-term care insurance in California is currently low, and many families cannot afford the high cost of long-term care. Therefore, the California government must consider imposing a mandatory long-term care tax to increase the supply of long-term care services.

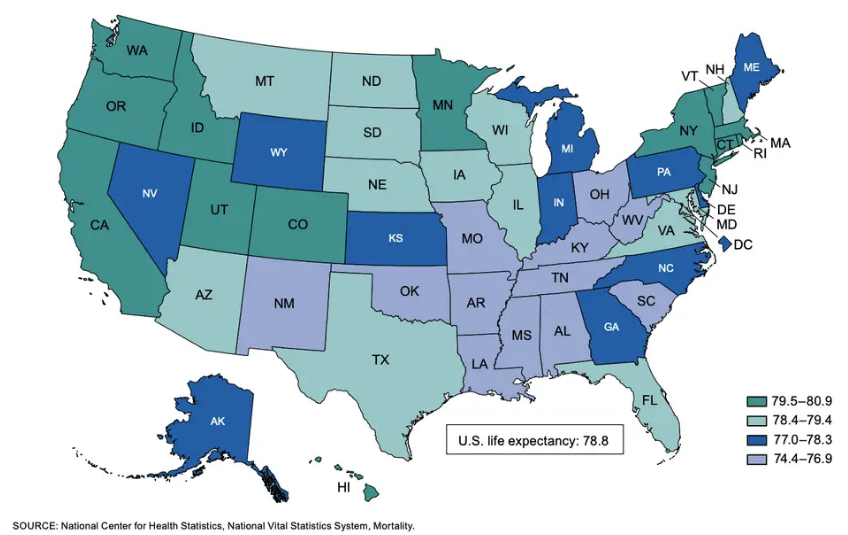

🔺 Life expectancy continues to increase. Data from the National Center for Health Statistics shows that the average life expectancy for California residents is between 79.5 and 80.9 years. Among the US population, Chinese Americans have the longest life expectancy. The average life expectancy for Chinese American men and women is 84.13 and 88.89 years, respectively, while their healthy life expectancy is 75.57 and 77.29 years, respectively. This means that, on average, elderly people have 3-12 years of living with illness, requiring either partial or full-time care.

Government Long-Term Care Planning

The California government plans to begin collecting a long-term care tax starting January 1, 2024, to supplement the funding for government-provided long-term care services. The specific tax policy details are still under discussion, but the basic policy is expected to be very similar to that of Washington State. According to the current California government proposal, the following two points may differ from Washington State:

🔺 It may include both employers and employees being subject to the long-term care tax. That is, not only limited to those receiving W-2 wage income, but business owners may also be taxed based on their income.

🔺 The option to opt-out is still unclear. If the opt-out option is available, it may require purchasing long-term care insurance before the legislation comes into effect.

This taxation method will increase the prevalence of long-term care services for the elderly in the future, encouraging more families to plan for long-term care in advance. In addition, the government can further encourage the public to purchase long-term care insurance by providing tax incentives, reducing the financial burden on the government.